Zooplus is the largest e-commerce pet supply company in Europe. If you happen to be familiar with Chewy.com in the US, Zooplus is the European equivalent.

Like Chewy, Zooplus has built up significant market share compared to both Amazon and the traditional bricks and mortar pet supply stores. The total pet supply market in Europe is still very fragmented with over 50% of pet supplies being purchased in grocery stores. Including bricks and mortar, Fressnapf is the largest pet supply company, but Zooplus is #2 and should surpass them within a couple years.

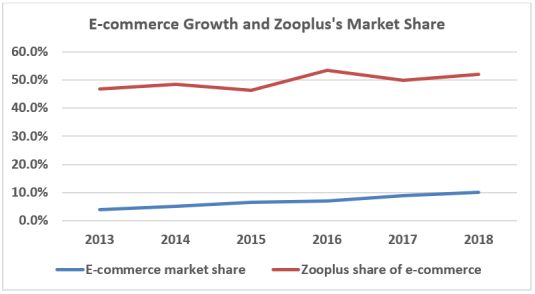

If we zero in on e-commerce, the pet supply market is much more concentrated. In 2018, Zooplus had 52% of online market share, followed by Amazon at an estimated 17%, and then the traditional pet supply companies behind them—Fressnapf and Pets at Home. Not surprisingly, e-commerce as a percent of total pet supply sales has increased every year, and I expect this to continue for many years. I don’t see any reason that online can’t make up 40%+ of pet supply sales in the future. E-commerce going from 10% industry penetration to over 40% is a major tailwind for Zooplus.

As you can see, Zooplus has dominated the European online pet supply market for quite some time. I think this scale results in pretty significant barriers to entry. Zooplus is the default destination for online pet supplies in Europe. Just overcoming the brand name recognition that Zooplus has (and Amazon in the #2 spot) would be challenging for a new startup, but competing on price would be even more difficult.

Historically, Zooplus has ran their business as a scaled economies shared flywheel. As Zooplus has grown, they have benefited from economies of scale. As a result of this, their cost structure has gradually decreased over time. As that has occurred, Zooplus has shared those cost savings with their customers via lower pricing. Looking at Zooplus’s gross margin and total operating expense margin over time shows a very clear trend. As they lower their operating expenses, they decrease their gross margin as well.

A small startup trying to break into this space would be starting on the left side of this chart with a much higher cost structure (actually, their cost structure would be off the chart to the left). As a result, they’d be forced to have higher prices or lose significant amounts of money competing with Zooplus on price—who themselves are barely profitable even with a scaled business.

Economies of scale are wonderful while they’re happening, but they are subject to the law of diminishing returns. Economies of scale are a result of fixed costs that are spread over more units as a business grows. But at some level of scale, the marginal benefit becomes virtually meaningless. I believe Zooplus is close to that point.

Around two-thirds of Zooplus’s operating expenses are logistics and fulfillment. While Zooplus’s overall logistics margin was 19.5% in 2018, their most efficient countries have logistics margins in the 13-15% range. But many European countries will never reach this level of efficiency because they are small (population wise), spread out, and detached from mainland Europe. Zooplus believes they can decrease their overall logistics margin by another 2-3%.

Behind logistics and fulfillment, each of Zooplus’s other operating expense lines is already in the low-single digits on a margin basis. There just can’t be much more leverage available in expense lines like personnel or marketing that are already so low. Marketing, specifically, has actually been on the rise the past couple years and management recently said this will continue.

we intend to increase our expenses to win customers and also take new, additional paths in the areas of marketing and customer acquisition… expanding our use of social media marketing and selected offline marketing tools… We plan to offset the higher marketing expenses by increasing our cost efficiency in other cost areas.

To be fair, Zooplus has done a great job historically of offsetting cost increases in one area (cost of goods sold) by lowering costs in other areas (personnel, logistics, marketing). But as I just discussed, I worry there isn’t much room left to decrease other expense lines. What concerns me even more is the trend in customer acquisition costs the past few years.

Many e-commerce companies go through this cycle where their customer acquisition costs look fantastic because early adopters are cheaper to acquire, but then marketing expenses later go through the roof. Ironically, many direct-to-consumer companies in the US have started opening physical stores because that is cheaper marketing than online ads.

Zooplus discussed this on their Q3 2018 call. They said online ad pricing has increased because their competitors are shifting more ad budget to online. Facebook and Google ads are auctions, so more competition means more demand and thus higher prices. Today, 80% of Zooplus’s marketing spend is online ads and Google Shopping. That makes them very susceptible to competitor pressure.

[Side note: I talked about this concept in my 2018 annual letter where I analyzed Trupanion’s competitive advantages. Companies that are overly reliant on acquiring customers via online ads are at a disadvantage vs companies that have more defensible customer acquisition models. Bidding up online ad auctions is simply too easy.]

Looking at Zooplus’s unit economics, the return generated from new customers is very susceptible to changes in customer acquisition costs. Using 2018 numbers, I estimate new customers generate a return in the 25-35% range. But as I just discussed, customer acquisition costs have gone up several years in a row and management expects this to continue. If marketing spend per new customer goes from €9.97 at yearend 2018 to €12.00, I estimate their returns on new customers would fall by around 10%, to a range of 15-25%. Another €1-2 increase in acquisition costs and the returns fall into the single-digits.

The unit economics calculation is also very susceptible to what margins Zooplus can earn at maturity. Their long-term earnings before taxes (EBT) margin goal is around 5%, but they basically broke even in 2017 and 2018. Thus, to reach their long-term financial goals, Zooplus needs to increase their EBT margin by around 5%. But when I look at the financials, this seems optimistic.

As I said above, it seems reasonable that they can decrease their logistics margin by another 2-3%. But beyond that, all of their other operating expense items are already in the low single-digits on a margin basis. To get to a 5% EBT margin, they need to find another 2-3% in decreases in the non-logistics operating expenses. If they’re not able to do that, the other couple percent would have to come from gross margin expansion.

I believe the most likely source of gross margin growth is their private label business, which is higher margin than the branded products they sell. As of yearend 2018, private label accounts for 14% of the food and cat litter category and is growing 1.6x faster. Zooplus believes private label can be over 20% of their business in a few years. This gross margin discussion is also where I want to dive into Amazon.

Amazon is the #2 online pet supply provider in Europe with around 17% market share. There has been a lot of discussion back and forth between Zooplus bulls and bears on how much market share Amazon may or may not steal from Zooplus. But I think this is missing the point.

My concern isn’t so much that Zooplus loses share to Amazon, but that Amazon has the scale to price pet food at a lower margin (or loss) if they want to. This could cap Zooplus’s ability to ever earn a profit. Amazon doesn’t need to overtake Zooplus in market share to negatively affect them because Amazon already has enough market share that lowering prices would harm Zooplus. In this scenario, it’s possible that Zooplus keeps their market share, continues to grow along with the online pet supply market, and still never reaches their profitability goal.

I worry the above may happen because pet food is such a valuable category for Amazon. Consumable products purchased on a regular basis are the bread-and-butter of Amazon. Pet owners spend a lot of money on their pets, even through recessions, which makes the category worth going after. Zooplus recognizes this Amazon threat. They went so far in their 2018 Capital Markets Day presentation to say that “Amazon is the only relevant long-term online competitor.”

Amazon is a concern because of their scale. Compared to other pet supply companies, Zooplus has a scale advantage in e-commerce that has led to a structural cost advantage. But Zooplus’s scale will never compete with Amazon’s. Amazon can price high value categories like pet food at breakeven (or at a loss) because they make up for it with Prime subscriptions and other product sales.

Why I don’t think Amazon needs more market share to harm Zooplus is because of the lack of switching costs in Zooplus’s business. Even though Zooplus has a 95% retention rate with its customers, if Amazon lowered their prices 10%, there’s not much that keeps most of Zooplus’s customers using their website. Zooplus seems well aware of this issue and it has tied their hands when it comes to price increases. On the Q2 2018 call, management said they “don’t want to be the first [pet retailer] sticking their head out passing on manufacturer prices increases.”

With that being said, I think management has done a good job of trying to increase how captive their customers are. First, private label is a smart way to increase switching costs. Just as a non-exclusive show on Netflix won’t encourage subscriptions like an exclusive show does, private label pet food results in higher switching costs. That is because pet owners can only buy that pet food in one place—from Zooplus.

In addition to increasing switching costs, Zooplus has also made purchasing more of a habit. Zooplus has been able to consistently increase their retention rate and how often customers order. The more frequent and automatic purchases are, the more of an ingrained habit buying from Zooplus becomes, and the less likely customers are to switch.

Now, all of that Zooplus vs Amazon discussion is well and good, but the proof is in the pudding (err, pricing). In January 2018, I did a pricing comparison of identical items between Zooplus and Amazon across the UK, Germany, and France (the three largest markets for Zooplus). The results were not too surprising. When comparing Zooplus to products that Amazon sells directly, the two were almost identical. When comparing Zooplus to products that Amazon sells both directly and through its third-party marketplace, Zooplus had meaningfully lower prices. Below is the summary.

[FYI, “1P” is generally used to represent Amazon’s direct business, while “3P” refers to their third-party marketplace.]

I followed this up by doing the exact same comparison two weeks ago. This time, the results surprised me. Across the board, Amazon’s pricing has worsened significantly and Zooplus is now clearly the cheaper option. Importantly, though, Zooplus has accomplished this pricing advantage while increasing their own prices: 5.3% in the UK, 4.1% in Germany, and 3.2% in France. Below is the summary.

Looking at this updated comparison, I believe the true numbers—what a customer would realistically experience when shopping the two websites—are between the above two rows. The biggest change from 2018 to 2019 is how many more of the Amazon items were sold via third-parties as opposed to directly by Amazon. In the 2018 comparison, 26.2% of the Amazon items were sold via the third-party marketplace. In the 2019 comparison, that jumped to 57.7%. A handful of these third-party items increased well over 100%, which skewed the “ZO1 vs AMZN 1P+3P” numbers.

Realistically, I don’t think any Amazon shopper is going to buy the products that cost multiples of what they can be purchased for from other places. That is why I said, “what a customer would realistically experience when shopping the two websites.” It’s tempting to remove the outliers, but anywhere I draw the line is going to be subjective. Nonetheless, precision is not required. I am confident that Zooplus is meaningfully cheaper than Amazon in the UK, Germany, and France, both on a current absolute basis and compared to where the two were last year.

Last summer, Amazon announced that it was starting to sell its own private label pet food in Europe. Given the above comparisons, it seems like Amazon is focusing more on private label and less on the direct 1P pet food business. As Amazon carries more of their private label pet food, they are carrying fewer of their competitors’ products.

When Amazon made that private label announcement last summer, many Zooplus bears jumped on the news as a bad sign. The overall market agreed as Zooplus’s shares fell. But I think Amazon focusing on private label and letting third-parties sell most other brands could be a good thing for Zooplus. Zooplus crushes Amazon’s third-party pricing. Looking at the above comparisons, it is quite obvious that Amazon’s third-party sellers cannot price pet food as low as Amazon or Zooplus can.

More importantly, if Amazon focuses on private label pet food, they won’t overlap as much with Zooplus. The less Zooplus has to directly compete with Amazon on price, the better. As I discussed above, I believe Zooplus is going to struggle to reach their 5% EBT margin goal strictly by decreasing operating expenses. They should have another 2-3% available margin in logistics. However, the rest of their operating expenses are already quite scaled, so decreasing those by a combined 2-3% could be difficult. Thus, I predict Zooplus will need to increase gross margin a couple points to reach their financial goals.

Private label is helping their gross margin but competing less with Amazon would probably help even more. The more Amazon focuses on their own private label brands the less they seem to focus on the rest of their direct sales. And the less Zooplus goes head-to-head against Amazon on pricing, the better.

Counteracting some of these positive trends is that Zooplus’s customer acquisition cost has been increasing and will continue to do so for the foreseeable future. How these factors develop in relation to each other will determine if Zooplus is ever able to reach their financial goals.

Zooplus put what I thought was a surprising statement on the last slide of their 2019 Capital Markets Day presentation, but after updating my pricing comparison, it started to make more sense:

Zooplus competitive position today stronger than 12 months ago.