In October 2023 I published a 12-page writeup titled “Lemonade: Short-Term Headwinds Will Soon be Tailwinds.” Fourteen months later, it looks like that title is turning out to be quite prescient. My last paragraph in that writeup was the following:

As inflation inevitably slows down and Lemonade’s rate increases get approved, their loss ratios should come down. This will also allow them to turn marketing back on and thus growth will accelerate. As their heavy investments to build out their three new lines of insurance are mostly complete, I expect [2024’s] growth to have high incremental margins and prove once more the operating leverage Lemonade has. Reaccelerating to 20-30%+ growth while loss ratios decrease and margins increase should result in a significant sentiment shift in Lemonade’s stock.

In summary, I predicted four things:

- Loss ratios would decrease

- Growth would accelerate

- Margins would increase

- Sentiment would improve

All four of those things happened in 2024, but more importantly, I expect 2025 to be the real inflection. I predict all of those same four things will happen again in 2025. Let’s walk through why.

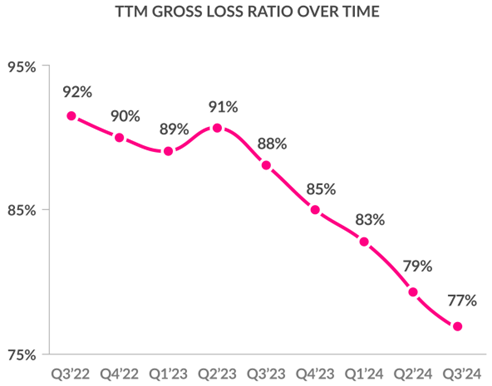

Lemonade’s gross loss ratio from 2021 to 2023 was 90%, 90%, and 85%. These elevated loss ratios occurred for four primary reasons.

First, there was (and still somewhat is) a period of high inflation coming out of Covid. And due to how insurance regulations work in the US, insurers are perpetually a year behind on correcting their prices. In normal times, this is fine and accounted for. During high inflation, it hurts.

Second, from Q3 2020 to Q4 2021, Lemonade launched three new products: pet, life, and auto insurance. New insurance products have high loss ratios in their early years due to immature pricing models and first year customers having the worst loss ratios.

Third, there was a string of bad catastrophic events that affected the entire industry and really hurt Lemonade’s home insurance segment.

Finally, I suspect some of this was self-inflicted due to management trying to kick start home and auto growth with low prices. In normal times that might be defensible, but their timing was very bad.

Nonetheless, a lot of this was out of their control and just the result of a perfect storm of bad things coinciding. But there was also a clear solution: apply for rate increases, wait for them to get approved, and stop offering insurance to the worst regions and/or customers (like homeowners in hurricane-laden Florida).

Management did all of this and by late 2023 it was obvious this was working. It just required some patience until the numbers shined through.

I expect the loss ratio to continue to decrease and then settle within their desired range of 65-75%.

When loss ratios increased, unit economics got worse, so the smart thing to do was to slow down growth and wait for rate increases to get approved. And that is exactly what management did. But the stock market hates it when a company’s growth slows down significantly. Below is what the market sees: growth dropping from +50% to +18% in just one quarter.

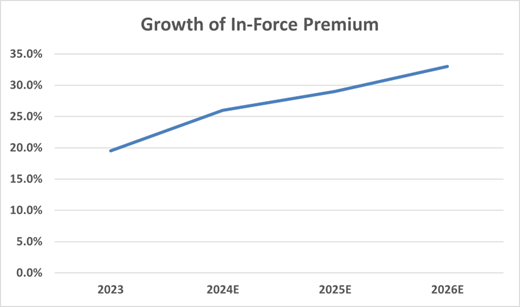

But again, this was just a short-term headwind as rate increases were waited out. This was not demand petering out. And this short-term headwind has now reversed. As rate increases are coming through, more growth is getting turned back on. 2024 will show accelerating growth of around +26%, and then management guided to both 2025 *and* 2026 accelerating growth on top of that. 2024 growth faster than 2023, 2025 faster than 2024, and 2026 faster than 2025. That is rare in public companies.

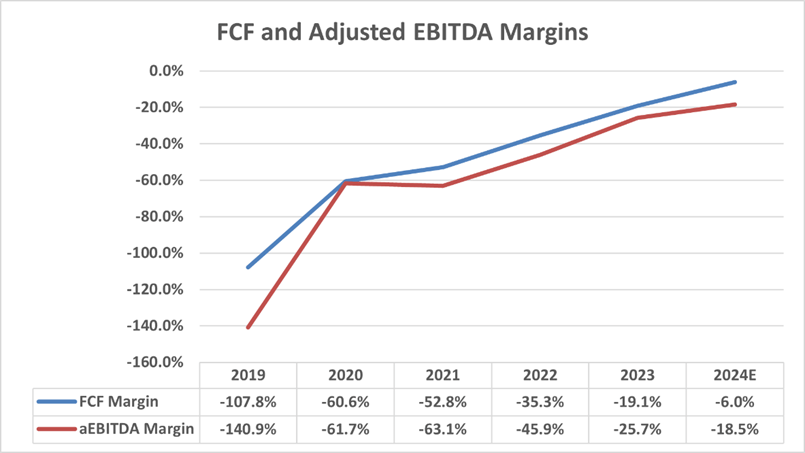

Throughout Lemonade’s history, they have shown a lot of operating leverage (i.e., increasing margins and profitability as they grow). If they wanted to grow slowly and be profitable today, they could. But they have great unit economics, so it’s better to balance faster growth while slowly reaching profitability over time. Below is how their profitability has trended up until now.

Profitability continues to increase because Lemonade is able to grow while barely increasing operating expenses or headcount. The below chart is from their 2024 investor day.

Since 2021, they have grown premiums at a 25% CAGR while growing headcount at a 2% CAGR. That is incredible. I don’t think I’ve ever seen a company grow the topline so much while barely increasing headcount.

That dynamic cannot continue for long without Lemonade becoming very profitable. And management has made it clear this is the expectation going forward. Adjusted EBITDA margins are expected to improve by another 5-10% in 2025 and reach profitability in 2026. GAAP net income profitability is expected to be reached in 2027.

Finally, I predicted that when the above three things happened—loss ratios decrease, growth increases, margins increase—there would be “a significant sentiment shift in Lemonade’s stock.”

Now, the vast majority of the time it is a fool’s errand to try to predict market sentiment over a one or two-year period. But in this case, I think it was predictable. If a company is extremely hated and highly shorted, which Lemonade was, and is about to accelerate growth while increasing margins, the market is going to pay attention. That combination—accelerating growth while increasing margins—is a rare combination.

Even better, Lemonade guided to this combination of accelerating growth and improving margins continuing for three years. I don’t recall ever seeing that before. Once this became obvious to the market, I couldn’t see a way that more investors would not start paying attention. And I expect more investors to pay attention and sentiment to continue to improve over the coming years. Based on management commentary, below is what I expect growth and profitability to roughly look like through 2026.

If Lemonade accelerates growth and profitability like this, it is hard to imagine the stock not doing very well. After 2026, I expect growth to settle into the high 20s to low 30s for a few years and for profitability to continue to improve.

Now, that’s all well and good, but 2025 is critical to Lemonade and what I think their long-term potential ultimately will be. And that is because 2025 is the year of car. Until now, Lemonade’s car segment has seemed tantalizingly unattainable. Their initial launch had bad timing and rate adequacy has taken years to get in line. But finally, it seems the time is here. Over the past five quarters their car loss ratio has decreased from 104% to 82%, and that trend is expected to continue.

In Q3 2024, Lemonade’s average premium per customer was $384 per year vs their average car customer that spent $1,751 (4.5x their average). Unfortunately, the car segment only grew +3% in Q3. But car growth is about to accelerate significantly, and along with it, Lemonade’s overall business should drastically improve.

In the US, the name of the consumer insurance game is bundling. Insurers offer discounts to customers who use two or more of their insurance lines, and customers gladly accept those discounts. Today, less than 5% of Lemonade customers are multi-line customers vs incumbents at over 50%. The fact that Lemonade has done as well as they have with basically one hand tied behind their back is impressive.

Bundling is critical because of how beneficial it is to an insurer’s business. Cross-selling a current customer on a different insurance product is essentially free, or at least significantly less expensive than going out and marketing to acquire a new customer. Bundled customers are less risky, spend more money, and have higher retention rates.

in those states where we have all the policies available, for those customers who have multiple policies all the dynamics are much stronger. Retention is better. The willingness to buy that third policy is higher. Loss expectation, the risk profile tends to be better. All the metrics are better for that type of customer. – Tim Bixby, CFO, Q3 2024 earnings call

As of Q3, Lemonade has 2.2 million customers and estimates that 1.2 million of them have car insurance *not* with Lemonade. 700,000 people are currently on the waitlist for Lemonade Car. Obviously not all of these people will sign up for Lemonade’s car insurance, but many will. And these customers will be acquired for essentially zero dollars. As Lemonade’s percentage of multi-line customers grows well beyond 5%, the economics of the entire business improves.

With that being said, there is a big difference between talking the talk and walking the walk. All the signs point to Lemonade’s car insurance product exploding in growth with great unit economics in the near future. I believe it is going to happen. Management is extremely confident it will happen. But the company still has to go out and do it.

This is why 2025 is so critical. Succeeding in car means Lemonade’s addressable market is orders of magnitude larger than just pet and renters. This is because the ability to bundle several lines of insurance together is critical to compete on a bigger scale with the likes of Allstate, GEICO, and Progressive.

Given Lemonade’s car segment only grew +3% with an 82% adjusted loss ratio in Q3 2024, I need to see significant improvement through 2025 to deem it a successful year. Backdooring into car expectations based on management commentary, I expect car in-force premium to grow over 40% in 2025 with loss ratios in the 70s. And I expect car growth to remain at elevated levels of 40%+ for several years. As more customers are bundling multiple lines of insurance with Lemonade, I also expect retention to improve and premium per customer to accelerate.

There are always execution risks and unknown unknowns, but if Lemonade achieves the above in 2025, I think they will have a pretty clear path to being a $10+ billion-dollar company. After that, who knows.

Today, Lemonade is a $3 billion dollar company. Allstate is $50 billion. Progressive is $150 billion. If Lemonade’s car product proves successful, I will be back here next year explaining more in-depth what I think their long-term future can be.