Since my original Lemonade writeup two years ago, its stock is up 6x. I think its next 6x is more likely and less risky than the last 6x. When Lemonade’s stock was in the teens throughout 2023 and most of 2024, there were legitimate questions about the company’s long-term potential. To me, the biggest question was whether Lemonade could extend its success in pet and renters insurance to the more complex and competitive markets of home and auto. Today, I don’t have any major concerns about Lemonade, and I am far more confident in their future than I was two years ago.

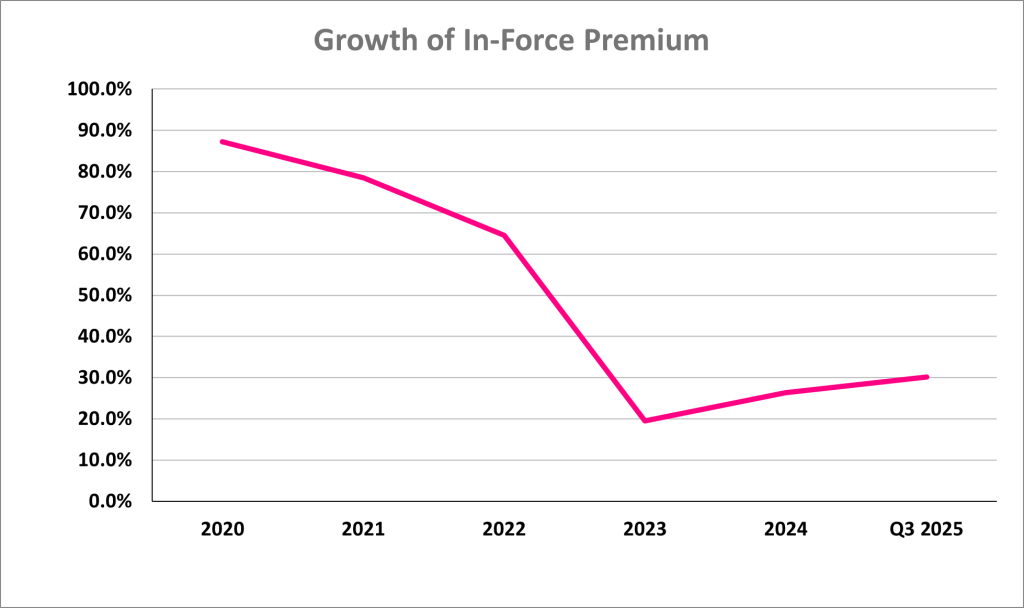

Lemonade is going through a major multi-year transition. They are evolving from a niche insurer to—what I believe—a serious player in the consumer insurance industry. In my December 2024 writeup I called out 2025 as being critical for Lemonade to become a serious contender to the likes of Allstate, GEICO, and Progressive. Below is exactly what I said.

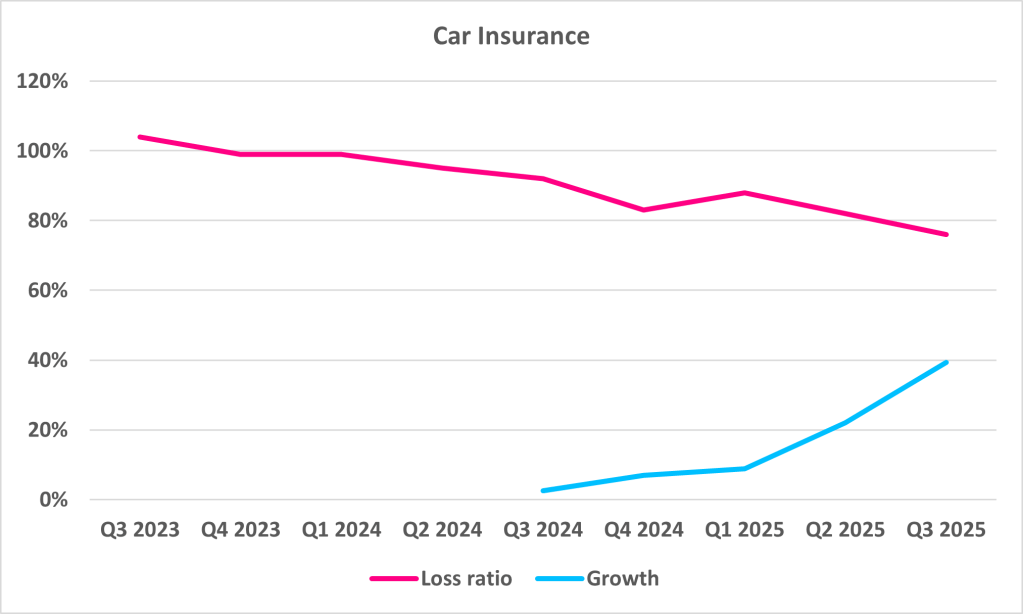

2025 is critical to Lemonade and what I think their long-term potential ultimately will be. And that is because 2025 is the year of car. Until now, Lemonade’s car segment has seemed tantalizingly unattainable. Their initial launch had bad timing and rate adequacy has taken years to get in line. But finally, it seems the time is here… Unfortunately, the car segment only grew +3% in Q3. But car growth is about to accelerate significantly, and along with it, Lemonade’s overall business should drastically improve.

…

As of Q3, Lemonade has 2.2 million customers and estimates that 1.2 million of them have car insurance *not* with Lemonade. 700,000 people are currently on the waitlist for Lemonade Car. Obviously not all of these people will sign up for Lemonade’s car insurance, but many will. And these customers will be acquired for essentially zero dollars.

With that being said, there is a big difference between talking the talk and walking the walk. All the signs point to Lemonade’s car insurance product exploding in growth with great unit economics in the near future. I believe it is going to happen. Management is extremely confident it will happen. But the company still has to go out and do it.

Given Lemonade’s car segment only grew +3% with an 82% adjusted loss ratio in Q3 2024, I need to see significant improvement through 2025 to deem it a successful year. Backdooring into car expectations based on management commentary, I expect car in-force premium to grow over 40% in 2025 with loss ratios in the 70s.

So, let’s review 2025 (through Q3 at least, Q4 results are not out yet).

I am happy to say Lemonade is achieving what I predicted. Since only growing 3% in Q3 2024, car’s growth has accelerated four straight quarters: 7%, 9%, 22%, 39%. And management guided to car’s growth continuing to accelerate, so they are right on target to grow over 40% in Q4 2025. Similarly, car’s loss ratio hit its low of 76% in Q3 2025 and is expected to continue decreasing. Both trends are going in the right direction as expected.

In my original 2023 writeup, I emphasized car insurance as the biggest risk to the long-term bull thesis.

The biggest company-specific concern I have is their transition from renters’ insurance, which is not the most competitive line of insurance, to home and auto. In addition to being more competitive, home and auto are also more complex. Lemonade has offered home insurance for years, but they have purposefully kept that segment small. Going forward it will be a bigger part of their business. Likewise, Lemonade has made major investments in building out auto insurance the past couple of years. With inflation increasing this year, auto has had a bit of a delayed start, so success is yet to be determined. With how important bundling is in the insurance industry—both for price discounts and for customer retention—I view Lemonade’s success in home and auto as crucial.

Without home and auto insurance, Lemonade could be a successful niche insurer for pet and renters, but car is critical to Lemonade graduating to the big leagues for two reasons. One, auto insurance is simply a massive industry. Pet and renters insurance in the US are less than a $20 billion dollar industry combined (though growing quickly). Auto insurance is over $300 billion.

Second, in the US, the name of the consumer insurance game is bundling. Insurers offer discounts to customers who use two or more of their lines of insurance, and customers gladly accept those discounts. Today, a little more than 5% of Lemonade customers are multi-line customers vs incumbents at over 50%.

Overall, I am very satisfied with Lemonade’s 2025 results, and I am more confident in their long-term potential. Q3 2025 was their first great car quarter, so they have to prove it wasn’t a fluke, but that will almost certainly happen over the next couple of quarters. Then I think it’s off to the races: one of the biggest risks to Lemonade’s long-term success will be dead, and they will have a full suite of insurance products to offer and bundle to customers.

My original Lemonade writeup in 2023 was titled “Short-Term Headwinds Will Soon be Tailwinds”, and my 2024 writeup was an update on those headwinds turning into tailwinds. In short, those writeups were both focused on the perfect storm of headwinds that affected their business for several years, and how Lemonade was going to get through them over the medium term. Now that those headwinds are behind us, I want to talk more about Lemonade’s long-term potential.

Today, Lemonade is a $5 billion dollar company. Allstate is $50 billion. Progressive is $130 billion. There are many reasons that I believe Lemonade is going to be seen as equal to those industry giants within the next five to ten years.

First, Lemonade is a much more tech-oriented company than their larger competitors. Lemonade does not sell its insurance via agents and brokers, instead focusing on online ads, fun social media presences, and word-of-mouth that comes from their high net promoter scores.

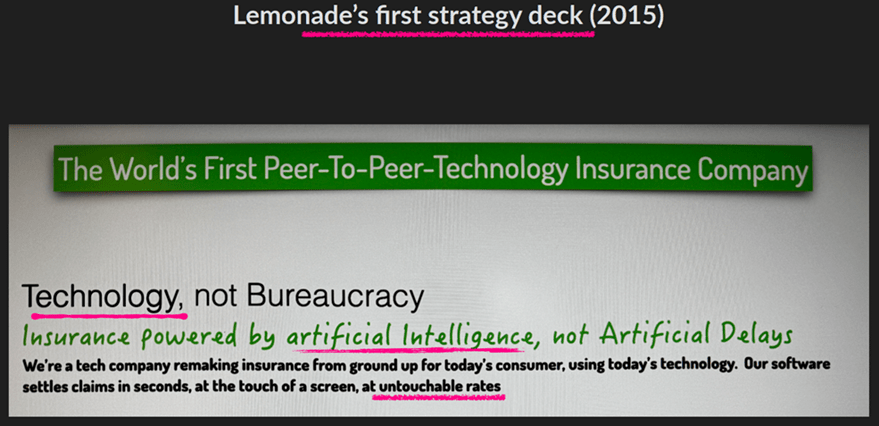

When it comes to tech ability, I view companies in three broad groups: legacy, tech-first, and AI-first. Legacy companies are generally those founded before the late 1990s. Those companies were founded before the internet existed and thus their company cultures are generally not tech-first. In the late 1990s companies like Amazon and Netflix were founded. To their core, they are inherently tech-first companies. And now, there are AI-first companies.

I believe AI is going to transform close to everything we do. That opinion is not uncommon, and thus AI has been booming the past few years. But all AI is not created equally, and company cultures are very hard to change. In many industries, I believe true AI-first companies are going to carve out very meaningful market share. Behind them, tech companies will generally adopt AI better than legacy companies.

When thinking about what industries are ripe for AI, insurance is near the top of my list. Insurance is one of the largest, oldest, and most data-driven industries in the world. I don’t expect great insurers like Progressive to go anywhere (Walmart and HBO still exist!) but I do expect an AI-first insurer to become a large player.

ChatGPT exploded onto the world in early 2023. And since then, seemingly every public company has discussed or “implemented” AI. But true AI-first companies were using AI before it was cool. Lemonade has been discussing AI regularly since they were founded—long before ChatGPT was a thing and before they were going public.

At Lemonade’s 2024 investor day they showed off their internal AI system called Blender in a very impressive demonstration. Co-founder and tech lead Shai Wininger occasionally tweets other demonstrations of their AI. Lemonade has shown off some of the most impressive AI of any company that I have seen.

The majority of their code and software engineering is already written by AI, and this is helping their business in many ways.

The very nice thing about using AI to do this work is that it’s never at the cost of customer service. It is to the delight of customers. The overwhelming majority of complaints that we get, I think well over 90% are for things that humans do rather than AI… we only deploy the technology once it reaches very high levels of customer satisfaction. And once it does that, it exceeds what humans do because it’s much faster. The error rate is often lower. So, we’re seeing it able to handle ever more complex things. – Daniel Schreiber, Q3 2025 earnings call

This tech advantage is partially due to Lemonade’s commitment to having a single tech platform built from day 1. And this is not something any of their more mature competitors will ever be able to replicate. The legacy insurance companies have tech stacks cobbled together through decades of M&A that cannot be undone.

Geico’s technology needs a lot more work. It has 600 legacy systems that don’t talk to each other. – Ajit Jain, Berkshire Hathaway 2023 annual meeting

Lemonade’s obsession with AI and technology creates a user experience that is simply better than their competition, and I don’t think that will easily be replicated.

In an industry where most of their competitors are disliked by consumers, Lemonade is loved. Their net promoter scores have been in the 60s and 70s since they launched. That is a very high score that is more comparable to beloved consumer software like Apple than it is to an insurance company. An impressive data point was that the net promoter score for Texas residents who filed claims during the February 2021 freeze remained stable. Even more impressive, the net promoter score from customers who have had claims denied has historically been in the 40s and 50s. Users who get denied on the single thing they pay insurance companies for still rate Lemonade highly. That is extremely impressive.

Importantly, I don’t expect this tech advantage to go away anytime soon. Tesla is still the gold standard for technology in cars. Amazon Video and Hulu still have worse UI than Netflix. YouTube Music still has worse functionality than Spotify.

I think investors as a whole underestimate how much company culture matters. This same culture point goes for tech companies vs non-tech companies. It is a great divide that is very difficult to cross.

Historically, the most successful insurance companies have led the industry in technology. GEICO and Progressive have both been considered innovators in the insurance space at different points in their history. I see Lemonade as simply the next iteration of this trend.

A lot of my investing is based on analyzing founders because I believe company culture is so incredibly important. But as important as culture is, it is equally difficult to change. All company culture flows downstream from the culture that the founders started on day 1. And founders can’t be changed. Thus, culture can’t be changed (with rare exceptions).

The two co-founders of Lemonade are Daniel Schreiber and Shai Wininger. I have spent most of my investing career focused on founder-led companies, and Daniel and Shai are right up there with the best leaders I have come across. Daniel, as the CEO, is extremely well spoken and warm, communicates clearly, has been honest about their ups and downs, and has allocated capital well. Shai, as the CTO, is obsessed with creating the most technologically advanced company in the world with the most user-friendly and beautiful app. His perfectionism when it comes to design reminds me of Steve Jobs.

Of the ten largest P&C insurance companies in the US, Progressive is the youngest at 88 years old. They were founded in 1937. Obviously, it is very difficult to start a new insurance company in the US. The regulations are immense, the capital requirements necessitate a lot of funding, and getting pricing models correct takes many years of tinkering while losses mount. I think Tesla is a good analogy here as they were the first new auto OEM to successfully break into that industry since the 1950s.

Launching a new insurance company requires a delicate balance between growth and profitability. There are a lot of fixed costs that go into running an insurance company, so scale is needed to cover those costs and generate profits. But growing too fast increases capital requirements, which means raising more money as a loss-making startup. It is also difficult to only grow in segments that have good unit economics. Young insurance companies can easily go into death spirals if they attract the wrong customers and are forced to keep raising prices to make up for those bad customers.

Daniel and Shai have done very well growing Lemonade in the right way. They have continuously focused on growing the most profitable lines of insurance in profitable regions while tampering down growth in other areas. When Lemonade ran into a perfect storm of headwinds from 2021 to 2023, they halted growth until inflation slowed down, rate increases got approved, and loss ratios decreased.

Daniel and Shai handled this difficult period very well, but the stock market always hates slowing growth and its stock got pummeled. They also made several great capital allocation decisions, raising $1 billion dollars in 2020 and 2021 when the market was hot, but then finding creative ways to grow with less cash burn when the market shifted (Chewy partnership, Synthetic Agents).

In short, I have followed and owned Lemonade through boom and bust periods, and Daniel and Shai have performed admirably, and have been honest about headwinds when facing them. In my eyes, they have proven themselves as very capable leaders who can adjust to good and bad times and grow Lemonade in the right way.

In addition, I think Daniel and Shai made some really smart decisions from day 1 in how to structure Lemonade. Lemonade is not a typical corporation; they are structured as a public benefit corporation. This means their fiduciary duty legally lies with the public as a whole—not just shareholders.

Lemonade is a Certified B Corp, meaning they meet “rigorous standards of social and environmental performance, accountability, and transparency”. Their annual Giveback program donates millions of dollars to charities of their customers’ choice. And the Lemonade Foundation was funded with 1% of Lemonade’s stock to help charities the company is especially interested in.

Since launching, Lemonade has garnered a lot of positive attention due to their focus on charity. I think this focus helps attract great employees, is appealing to the younger generations of insurance customers, and is simply a good thing to do. This charitable image is very different than how most insurance companies are viewed by consumers. As Daniel said, he “wanted to create an insurance company that has an entirely different word cloud associated with it.”

Finally, Lemonade’s mission to improve the world by rebuilding insurance is a very big and difficult problem. I believe this is meaningful when it comes to attracting the best talent. The best programmers and the smartest, most motivated people want to solve huge problems. I have heard many successful entrepreneurs discuss this very thing: the harder the problem the easier it is to attract great talent. I think if 100 top engineers wanted to help fix insurance they would be more attracted to Lemonade than any of their competitors. And the charitable image doesn’t hurt.

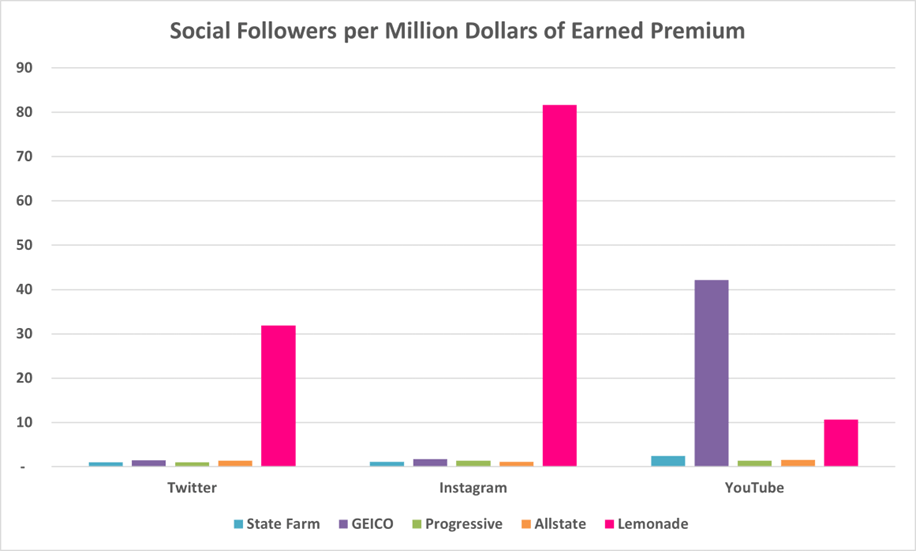

To be a $50+ billion-dollar gorilla in this industry, a company needs to sell multiple lines of insurance that consumers can bundle together, and the company needs to be damn good at marketing those lines of insurance. In this regard, Lemonade punches far above their weight. I think Lemonade already has the best branding in the consumer insurance industry, and some of the best branding of any company, period.

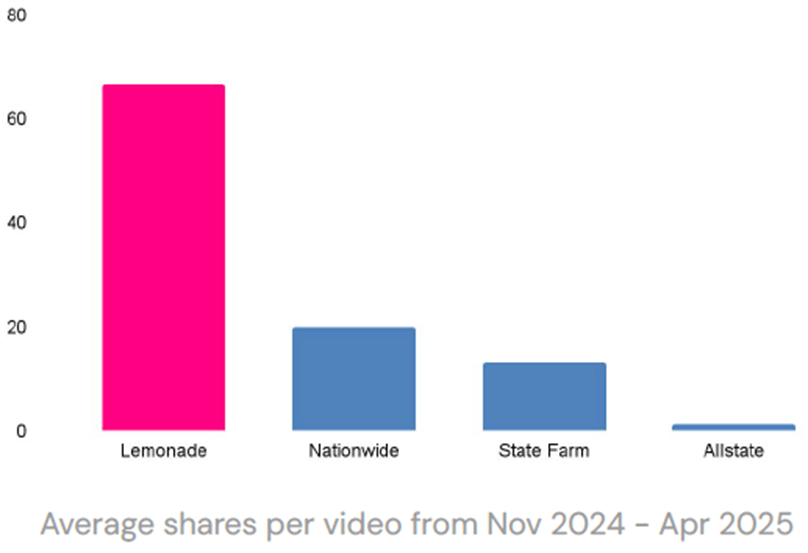

The below chart proves how much Lemonade punches above their weight when it comes to insurance marketing. On Twitter, Instagram, and YouTube, their followers per million dollars of gross earned premium far exceeds the four largest personal insurance companies in the US.

RightMetric, a marketing research company, published a 58-page report earlier this year analyzing Lemonade that came to the same conclusion. In short, Lemonade is really good at marketing and already outcompetes the large incumbents in many ways. I highly recommend reading that entire report as it is very insightful.

Lemonade created a custom art style that is distinctive, memorable, and unique to them. Their color scheme is black, white and grey with very bright pink for emphasis. Their tone is refreshing, funny, and honest that speaks to younger generations in a way that Mayhem and the gecko do not.

Everything Lemonade does when it comes to design, branding, and marketing is extremely well thought out. Their ads. Social media posts. Copywriting. User interface. Shareholder letters. Commercials. Videos. I am a pretty tech savvy person, and the Lemonade app still routinely impresses me. It is one of the most well-designed apps I have ever used. And none of that happens by chance. Daniel and Shai are obsessed, and that comes out in so many seemingly minor details being perfect.

Between Lemonade’s massive technology advantages and the innovator’s dilemma, I don’t know how any of their current competitors could realistically stop Lemonade. Lemonade’s main advantage is their single proprietary tech platform that was built for AI from day 1. All of their success flows from this.

To recreate this, Allstate or GEICO or Progressive would require a herculean cultural shift to become true AI-first companies. They would have to attract top technology talent, both in the executive suite and among their programmers. Good luck with that. And they would have to completely overhaul or get rid of many thousands of employees and much of their networks of agents and brokers. This would require many years of investment and uncertainty and fewer profits and share price volatility and less bonuses.

If any of these legacy companies were founder-led, I would give them a small chance of doing the above. But as is, I think what I just described is basically impossible. Non-founder CEOs just don’t have the internal motivation to be obsessed with their company’s moat 10+ years from now. Just as important, hired CEOs don’t have the long-term job security that founders do, so they are not incentivized to make massive business changes that cost billions of dollars, thousands of jobs, and take many years. Executive teams and directors at these large insurers are incentivized to do well over the short term and keep their high salaries and bonuses rolling in. And don’t forget their shareholders who love GAAP profits and quarterly dividends.

A big reason why it is so difficult for incumbents to avoid the innovator’s dilemma is because they are very profitable, successful businesses, and the disruptive startups are small and seem like a very long-term risk, if they’re even a risk at all. But by the time the startup reaches escape velocity, it’s too late.

I heard a Marc Andreessen quote recently about AI that I think applies here:

If a technology transformation is sufficiently powerful, then you actually need to start the product development process over from scratch because you need to reconceptualize the product, and then usually what that means is you need a new company because most incumbents just won’t do that.

I continue to believe the best insurers like Progressive will do well for a long time. The regulatory landscape of insurance in the US almost assures the industry is slow moving. But I also believe that non-founder-led 100-year-old companies that won’t disrupt themselves will not stop Lemonade from also succeeding. On top of that, legacy insurers can’t stop Lemonade benefiting from what I believe is a better than average pool of customers.

Insurance is mostly seen as a commodity by consumers, so price sensitivity is high. The way to generate superior returns in insurance is to either operate the non-regulatory capital cost base with more efficiency (lower cost structure = lower prices) or to attract higher quality customers who cost less. I think Lemonade is doing both.

Many years ago, GEICO benefitted from positive selection in its customer base (the opposite of adverse selection) as their customer base of government employees was more financially stable and made less claims than non-government consumers. For two reasons I think it is possible that Lemonade also benefits from positive selection.

First, Lemonade’s image as a charitable company may attract a user base that is slightly more honest than the overall pool of insurance users. Second, Lemonade’s superior tech and app experience may increase customer satisfaction and thus retention.

In a commoditized, price sensitive, low margin industry like insurance, a few small differences at the margins can add up to be meaningful. Focusing on charity and technology might be two of those small differences.

Along with that, I believe Lemonade’s technology is starting to show its efficiency advantage relative to competitors, as described below in reference to their loss adjustment expense. Having a more efficient business means a lower cost structure and thus the ability to offer lower prices, which management emphasized during their 2024 investor day and Q3 2025 earnings.

Over the past three years, we’ve almost halved our LAE ratio, from 13% to 7%, largely due to our ability to harness AI to drive automation. Notably, our claims department shrank in absolute terms, even as claims volume increased by >2.5x during this period! Said differently, we have seen a near tripling in claims handling efficiency. We have demonstrated our ability to transform claims handling expense, long considered a variable expense in insurance, to a near-fixed expense. To put our 7% result in context, many leading incumbents report LAE ratios around 9%, despite being at least an order of magnitude larger than us. Size typically brings natural efficiency advantages, so achieving a materially lower LAE, while at a fraction of their scale, bodes well… we expect to cut LAE ratio in half once more, alongside the next doubling of the business – Q3 2025 Shareholder Letter

Today, Lemonade serves over 2,300 customers per employee. Public insurers like Progressive and Allstate have a few hundred customers per employee—and generally under 200 if you include agents. This makes sense to me. Frankly, I would be surprised if Lemonade’s single tech platform built in the past ten years couldn’t outperform hundreds of legacy systems cobbled together over many decades.

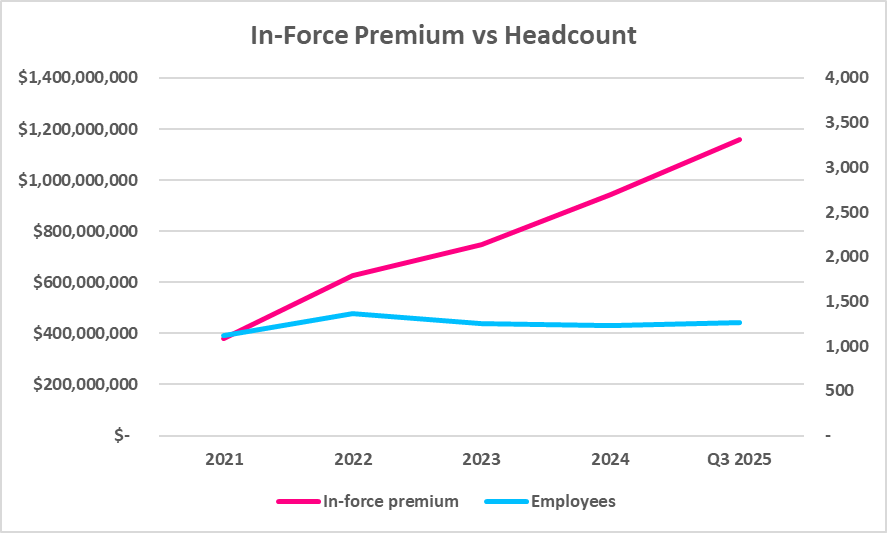

The two charts below very clearly demonstrate how much more efficient Lemonade is becoming, and I believe these trends will continue for many years.

In four years, from 2021 to Q3 2025, Lemonade’s employee headcount increased 12.5% total, from 1,119 to 1,259. In that same time, their customer count increased 101% and their in-force premium increased 204%.

Management has guided to these trends continung and I see no reason not to believe them. If that happens, it is likely that Lemonade will have a meaningfully more efficient and lower cost structure business than the likes of Progressive and Allstate. Lower cost structure means lower prices, which attracts more customers. More customers bring in more revenue to spread over that lower cost structure, which makes Lemonade even more efficient, and the flywheel spins on. Given the 100-year-old legacy insurer’s dated infrastructure and the innovator’s dilemma, this future is looking more and more likely by the day.

To sum up, two years ago I thought there was a real risk that Lemonade might not be able to figure out auto insurance. They had proven success in pet and renters insurance, but auto is much more complicated. The trends today are clear that they have figured out their car segment. A few more quarters like Q3 2025, and that risk will be completely laid to rest in my eyes.

With that concern out of the way, I do not have any meaningful concerns about Lemonade going forward—other than normal things like execution risk and black swan events. A part of me has believed this for years, but I am growing significantly more confident that Lemonade could become a generational type of company—transforming consumer insurance the way Tesla has transformed the auto industry.

From a high-level, long-term perspective, this is what my Lemonade bet is:

- AI is eventually going to significantly impact virtually every industry.

- Insurance is one of the largest, oldest, and most data-driven industries in the world.

- An AI-first company will eventually be a large player in the consumer insurance industry.

- Lemonade has a large head start on being that AI-first insurer.

I think all four are hard to argue against. The more I learn about and use AI, the more convinced I am that it is going to massively transform virtually every part of our lives over the coming decades—moreso than even the Internet. And insurance, given how old and data-driven it is, is ripe for AI. Finally, it is clear to me that today, Lemonade has the best chance of becoming the AI leader in consumer insurance. But of course, having a head start does not guarantee a win. Incumbent insurers will evolve, new startups will emerge, and there is always execution risk—maybe Lemonade just fumbles the ball.

In a nutshell, this is my elevator pitch: someone will make tens or hundreds of billions of dollars transforming consumer insurance with AI, and Lemonade currently has the lead. And they have the right culture, the right founders, and the positive reinforcing flywheels to maintain that lead.