During my initial Lemonade research in 2021 I looked into Root as well. I was not overly impressed with Root as its own potential investment or as a Lemonade threat, so I moved on and only loosely followed it for the next few years. Throughout 2024 as I made Lemonade a significantly larger investment, I spent a lot of time researching any potential risks. And Root was part of that. This time I did a much deeper dive on Root… and more or less came to the same conclusion.

With that being said, I do think Root will be successful. Consumer insurance is not a winner-takes-all market, and Root has a great deal with Carvana. I think there is plenty of room for two tech savvy insurers to make space for themselves in this industry. But I think Lemonade is a better long-term investment than Root. As to why, I’ll start high-level and then zoom in.

Below are the first sentences of Lemonade and Root’s 10-K filings for 2024.

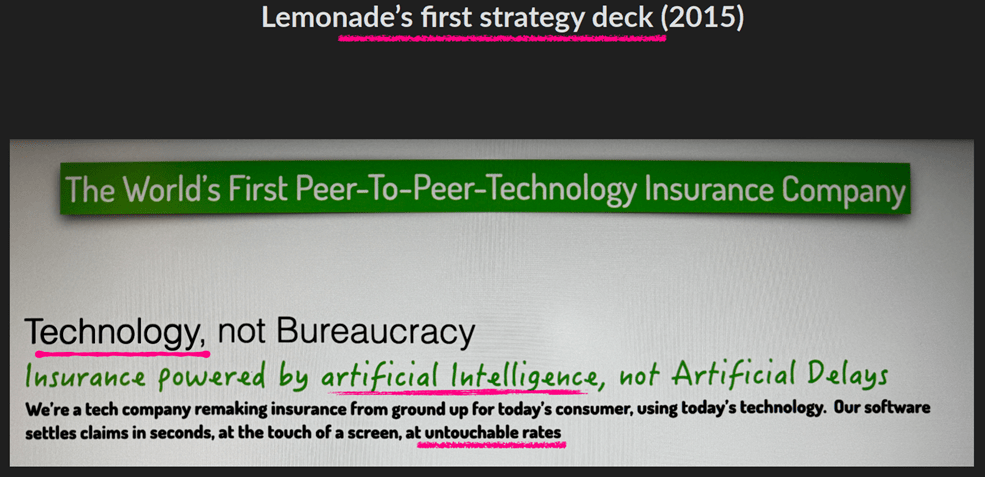

Lemonade is rebuilding insurance from the ground up on a digital substrate and an innovative business model.

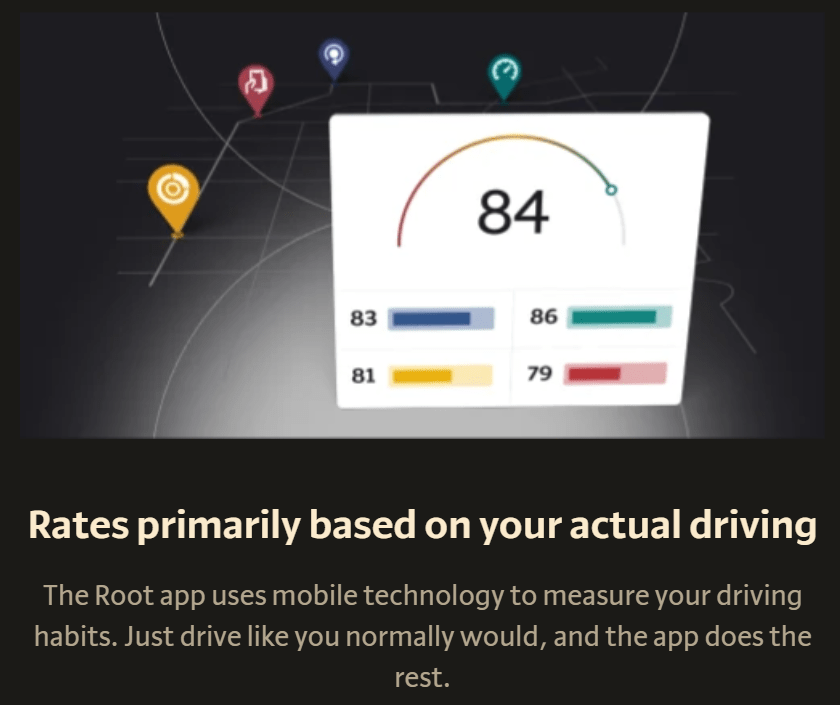

Root is a technology insurance company founded on the idea that car insurance rates should be based primarily on driving behaviors, not demographics.

Right away, just these two sentences demonstrate a lot of the differences between Lemonade and Root. Lemonade “is rebuilding insurance from the ground up” whereas Root believes “car insurance rates should be based primarily on driving behaviors.” Lemonade believes that same thing by the way. I hope both companies succeed in improving car insurance. But Lemonade has a much bigger vision. Their mission is to “harness technology and social impact to be the world’s most loved insurance company.” Root does not talk like that.

This difference is also clear on each company’s current home page.

A few months ago, Root’s home page headline was “You could save hundreds on your car insurance”. One sounds like GEICO. One sounds like something totally different.

In Google results, Lemonade’s home page description is “An insurance company built for the 21st century”; Root’s is “Car insurance for good drivers.” Again, the difference in messaging is stark.

I emphasize this difference in messaging for two reasons. First, I think some percentage of potential customers are going to be attracted to Lemonade’s mission of changing how insurance works and is portrayed.

Second, their mission to improve the world by rebuilding insurance is a much bigger and harder problem to solve than Root’s mission of improving car insurance. And I believe this is meaningful when it comes to attracting the best talent. The best programmers and the smartest, most motivated people want to solve huge problems. I have heard many successful entrepreneurs discuss this very thing: the harder the problem is the easier it is to attract great talent. I think if 100 top engineers wanted to help fix insurance they would be more attracted to Lemonade than Root.

Beyond just the messaging differences, Lemonade puts far more effort into their design and branding. Lemonade created a completely custom art style that is distinctive, memorable, and unique to them. Their color scheme is black, white and grey with very bright pink for emphasis.

Root, on the other hand, seems to have put close to zero effort into their design and branding. They have no cohesive color scheme, and their website is filled with stock photos that aren’t even high-resolution.

These images are not cherrypicked by the way. Both of these are from the company home pages and representative of the rest of their websites.

This contrast in design and copywriting also extends to ads, commercials, videos, and social media.

Lemonade has 70k followers on Instagram and has gone viral a handful of times for random funny stuff. Root has 16k followers and is much more what you would expect from an insurance company. Lemonade has 30k followers on Twitter, Root has 5k and hasn’t posted since September 2024. Lemonade posts videos on YouTube regularly. Root hasn’t posted in three years. I don’t blame Root for not posting because their old videos are basically stock photos with music on top. All of their videos are very generic and, frankly, just bad.

On the other hand, Lemonade makes legitimately great videos and commercials.

If you are familiar with Root, you might be thinking that a lot of this comes down to Root’s strategy of selling via embedded third parties vs Lemonade selling via online ads and word of mouth. I agree that Root hasn’t historically had to acquire customers in the same ways that Lemonade has. But that’s kind of the point.

Lemonade has built very strong skills in branding, marketing, and advertising. Root hasn’t had to. That is obvious. But to be a $100 billion dollar gorilla in this industry, a company needs to sell multiple lines of insurance that consumers can bundle together, and they need to be damn good at marketing those lines of insurance. I would argue Lemonade has the best marketing of any US insurer, and is orders of magnitude better than Root.

Next, let’s talk AI. When it comes to tech ability, I view companies in three broad groups: legacy, tech-first, and AI-first. Legacy companies are generally those founded before the late 1990s or early 2000s. Those companies were founded before the internet existed and thus their company cultures are generally not tech-first. In the late 1990s companies like Amazon and Netflix were founded. To their core, they are inherently tech-first companies. And now, there are AI-first companies.

I believe AI is going to transform close to everything we do. That opinion is not uncommon, and thus AI has been booming the past few years. With that, seemingly every company is adopting AI—whether they were founded five or fifty years ago. But all AI is not created equally, and company cultures are very hard to change. In many industries, I believe true AI-first companies are going to carve out very meaningful market share. Behind them, tech companies will generally adopt AI better than legacy companies.

When thinking about what industries are ripe for AI, insurance is near the top of my list. Insurance is one of the largest, oldest, and most data-driven industries in the world. I heard a Marc Andreessen quote recently about AI that I think applies here:

If a technology transformation is sufficiently powerful, then you actually need to start the product development process over from scratch because you need to reconceptualize the product, and then usually what that means is you need a new company because most incumbents just won’t do that.

Now, I don’t expect great insurers like Progressive to go anywhere (Walmart and HBO still exist!) but I do expect an AI-first insurer to become a large player. And my horse in that bet is Lemonade. Despite Root being founded in 2015, I am not convinced they are an AI-first company.

ChatGPT exploded into the world in early 2023. And since then, seemingly every public company has discussed or implemented AI. But true AI-first companies were discussing AI before it was cool.

In Root’s S-1, filed in October 2020, they mentioned AI four times. All four of those mentions were in boiler plate risk factors that they were probably legally required to include. They didn’t mention AI once when describing their business.

Lemonade’s S-1, filed in June 2020, mentioned AI 37 times, including in the second sentence of their business overview. Lemonade has been discussing AI regularly since they were founded—long before AI was cool and before they were going public.

Even in their 2024 10-K, Root now mentions AI 19 times—and all 19 are in boiler plate, legally required sections like risk factors and forward-looking statements. And I am not cherry-picking filings here. Their most recent investor presentation mentions AI once. Their latest shareholder letter mentions AI once in a legally required statement. Executive interviews and quarterly conference calls are similar.

Compare this to Lemonade’s demonstration of their internal AI system at their 2024 investor day and I am much more convinced that Lemonade is a true AI-first company. Beyond even insurance, Lemonade has shown off some of the most impressive AI of any company, period.

I suspect a lot of investors read this post and think “who cares if Root has a low-res image on their website and they don’t have bright pink ads?” As an outside investor, it can be difficult to get a sense of company culture. Every public company at least pretends to have an amazing and unique company culture. And even if you visit their office or go to their investor day, they are going to present themselves well. I think looking for a lot of small clues can give a more realistic picture of what goes on inside public companies.

Root dedicates very little copy in their 10-K to discuss company culture. The below quote is pretty much the extent of it.

Our team members achieve this mission with a focus on customer value, experimentation and innovation, disciplined thinking, and operational excellence. These four principles form the basis of our management approach and performance review model, ensuring clear expectations, meaningful mentorship and powerful growth.

You could copy/paste this into basically any public company 10-K. It is meaningless corporate speak.

Meanwhile, Lemonade’s 10-K oozes with how serious they are about their mission to change insurance in the right way. Lemonade is not structured as a typical corporation; they are structured as a public benefit corporation. In short, this means their fiduciary duty legally lies with the public as a whole—not just shareholders.

Unlike traditional corporations, which have a fiduciary duty to focus exclusively on maximizing stockholder value, our directors have a fiduciary duty to consider not only the stockholders’ interests, but also the Company’s specific public benefit and the interests of other stakeholders affected by our actions. – Lemonade 2024 10-K

Lemonade is a Certified B Corp, meaning they meet “rigorous standards of social and environmental performance, accountability, and transparency”. Their annual Giveback program donates millions of dollars to charities of their customers’ choice. And the Lemonade Foundation was funded with 1% of Lemonade’s stock to help charities the company is especially interested in. In short, it is obvious that Lemonade walks the walk that they claim to.

Everything in this post really boils down to differences in company culture. And company culture comes directly from founders. A lot of my investing is based on analyzing founders because I believe company culture is so incredibly important. But as important as culture is, it is equally difficult to change. Culture comes from the people who were there on day 1 starting the company. All company culture flows downstream from the culture that the founders started on day 1. And founders can’t be changed. Thus, culture can’t be changed (with some exceptions of course).

Alex Timm is very smart and is clearly a great entrepreneur. I have learned quite a bit from watching his interviews and reading his shareholder letters. But I don’t get the impression he’s a killer.

I think Daniel and Shai are killers in the same way that Ernie Garcia, Zuck, and Michael Jordan are killers. I think improving the consumer industry on a large scale is the life work of Daniel and Shai. Their ads. Social media posts. Copywriting. User interface. Shareholder letters. Design aesthetic. Their genuine attempt to design a user-friendly insurance company in a completely new way—from charity donations to how the company was structured from day 1.

I am a pretty tech savvy person, and the Lemonade app still routinely impresses me. It is one of the most well-designed apps I have ever used. And none of that happens by chance. Daniel and Shai are obsessed, and that comes out in so many seemingly minor details being perfect. They would never allow low-res stock photos on their home page.

The longer I invest the more my research really just boils down to analyzing founders. Everything flows downstream from the founders. And that analysis consists of dozens of small things that occasionally add up to the realization that “oh, this person is built different, and this company is built different.”