Want to invest in an industry set to grow 20x over the next 5-10 years? You and me both. Canada first allowed medical marijuana sales in 2014 and they’re already planning to legalize recreational use by 2019. With current marijuana sales of $200 million and the mature market size estimated at over $5 billion, there is a very long runway for growth. Predicting how a new industry will evolve is not easy, especially one that is inherently a commodity. There are quite a few public marijuana companies in Canada, but this is more of a high level blog post about the industry as a whole, not a specific buy or sell recommendation for any of those companies.

Background

In 2001, Canada implemented the Marijuana Medical Access Regulations (MMAR), which allowed patients to produce marijuana themselves, designate someone else to do it for them, or purchase it directly from Health Canada. Two-thirds chose to grow it themselves. Enrollment was 39,000 when Canada replaced the MMAR with the Marijuana Medical Purpose Regulations (MMPR) in 2013. Under the MMPR, patients receive a prescription from a doctor and then purchase the marijuana direct from a licensed producer. As of June, there were 32 licensed producers of medical marijuana—22 are fully authorized, four are owned by Canopy Growth, and three are owned by Mettrum. Thus, I believe there are around 15 separate companies that are fully authorized to produce and sell medical marijuana in Canada (with this number expected to grow as more companies are licensed).

The Liberals (led by Prime Minister Justin Trudeau) have also made it very clear that they intend to legalize recreational marijuana. Their goal is to have a bill introduced by next spring with legalization taking place in late 2018 or early 2019. First, there is obviously a risk that recreational use never gets legalized, but this risk appears small. The Liberals control the government and they have been planning this for years. Assuming recreational use does pass through the government, the next risk is how that market will be structured. Trudeau has said he’s watched Colorado and Washington’s differing approaches to legalization very closely.

First, Colorado has a lower tax rate (28%) vs Washington (44%) which results in gram prices of $15 vs $25, respectively (black market is at $10). Colorado also allows far more dispensaries than Washington. All this results in significantly less weed being sold on the black market in Colorado than in Washington (30% of the market vs 70%). Trudeau’s focus is on keeping weed out of the hands of youth and the revenue away from the black market. Thus, he probably wants it to be available as easily and cheaply as possible. Colorado allows vertical integration (producers can sell retail) while Washington does not allow producer-owned storefronts. Also, Colorado allows citizens to grow up to twelve plants at home, while Washington doesn’t allow any. Colorado encourages medical marijuana businesses to transition to recreational, where Washington does not.

Canopy Growth thinks marijuana laws will be regulated at the federal level, but details like distribution will be decided at the province level: “These policy objectives will help define Canada’s emerging cannabis industry, which will be regulated at the federal level aside from distribution channels, which will likely differ from province to province, similar to liquor distribution across the country today.” Large Canadian drug stores and the Liquor Control Board of Ontario (LCBO) have expressed interest at selling recreational cannabis. This means the current marijuana producers would only benefit as a wholesaler by providing marijuana to the store fronts. As you can see, there is a wide range of possibilities in how recreational use could be legalized. What the Liberals decide will ultimately determine how much the current licensed producers get to benefit from the recreational market.

I think it’s notable that two out of three MMAR patients grew marijuana for themselves. This surprised me. We’re all capable of growing our own food, but few of us do. The MMPR doesn’t allow home growing, but it’s possible recreational laws could change that. If that happens and home grow numbers come even close to the MMAR, that will dramatically affect the recreational industry.

Industry outlook

To become a licensed producer, a company has to go through a government approval process that can take up to two years. Many view this as a barrier to entry (valid point), but I don’t think it makes much of a difference with how many companies have already been licensed. Fifteen companies is more than enough to have a highly competitive industry. And highly competitive, commodity industries ultimately fall back on price and service for purchasing decisions.

In addition, every public marijuana company is increasing its grow capacity to capture market share in this fast growing industry (I assume the private ones are as well). This leads to overcapacity and price cutting. Once a large grow facility is built, they of course want to fill that capacity because incremental margins are higher. These high fixed costs push companies to decrease prices to increase sales and fill capacity. If you’re wondering, some price cuts have already begun.

Maintaining market share is going to be hard as more companies enter the space and the other 15 or 20 licensed producers ramp up production (probably trying to undercut bigger companies on price). This is just a guess, but big pharma or alcohol/tobacco could potentially enter the business relatively easily as they have the capital necessary to do it vs small startups that require financing (or seemingly unlimited share issuances via the public markets).

Market size

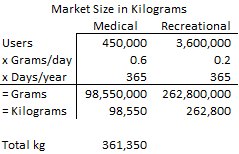

Health Canada used 450,000 as the upper limit of Canadians who might participate in the medical program by 2024. If 450,000 people buy 0.6 grams per day at $8 per gram, the mature medical market would be worth $800 million.

On the recreational side, Mettrum estimates 3.6 million users buying 0.2 grams per day at $15 per gram, which equates to a $4.3 billion market. Some of Mettrum’s competitors estimate the recreational market upwards of $10 billion, which seems quite aggressive. That is more than the Canadian beer industry. Below is the expected market sizes expressed in kilograms of weed sold.

So the mature Canadian market will sell an estimated 361,350 kg of marijuana per year. The problem is the current growers are expanding capacity like this is a certain outcome that is happening tomorrow, not next decade. Aphria is expanding their greenhouse to a capacity of 60,000 kg. They currently have ~8% market share, yet this expansion could supply 16% of the fully mature marijuana market. Canopy Growth’s production capacity is 595,000 square feet, though they don’t convert that to kilograms. Assuming it’s similar to Aphria’s facility, Canopy has capacity for up to 26% of the fully mature market. Mettrum will soon have 12,000 kg capacity and OrganiGram is expanding to 15,000 kg. In total, just these four companies have production facilities planned for 50% of the entire mature market. Given how uncertain and how far off that mature market is (and how many other competitors there are), 50% seems like a whole lot to me.

Public companies

Canopy Growth (CGC.V)

Mettrum (MT.V)

Aphria Inc (APH.V)

OrganiGram Holdings (OGI.V)

Emeral Health Therapeutics (TPI.V)

PharmaCan Capital (MJN.V)

If I had to take a guess, the above stocks will probably keep their upward momentum as revenues are increasing at very high rates. However, if marijuana turns out to be another commodity industry, long-term holders may not be happy. If the mature marijuana industry is $5 billion (medical + recreational), then a 10% market share is worth $500 million per year in revenue. Applying a commodity-like net margin of 3% results in net income of $15 million. For the largest companies that have the best shot at a 10% market share, $15 million in net income will not be enough for today’s stock prices to be attractive long-term.

The market size numbers are also based on maintaining current prices, but if the companies compete on price (as they already have been), there will be a double whammy of a smaller market than expected and lower margins. On the other hand, if the first mover advantage holds true (especially for the larger companies like Canopy, Mettrum, and Aphria) then it’s possible they’ll be able to hold prices with their customer base (and therefore maintain current margins). In that scenario, their net margins would expand as well.

I can’t help but see this industry evolving into a commodity one, but obviously a lot of people disagree with me. Are any readers invested in Canadian marijuana stocks? What am I missing?

As Marijuana becomes legalized in US and elsewhere, be very careful that you aren’t investing in the latest bubble. Lots of cash early on, but then lots of competition.

just a thought

LikeLike

There are some governance concerns at some of those businesses, to say the least.

LikeLike

I can’t help but draw some resemblance of Cannabis to that of the Tobacco business.

It is similar in characteristics with Tobacco in that it’s a psychoactive drug, and it’s addictive!

> Despite the handicaps placed on the Tobacco business, such as ban from media advertising, ugly packaging etc. it still sells.

> About $0.65 cents of every $1 sold at retail goes to Govt in the form of consumption tax. Despite elevation of tobacco prices by use of consumption taxes it still sells.

> The cost of production is less of a determinant in profitability despite taxes and regulation.

Such strong adverse forces would ruin most products & businesses, But tobacco stands (although it has consolidated with a handful of heavyweights). Such is the power of a psychoactive and addictive drug that operates under “legalise, regulate, and tax” system.

It has been argued that Tobacco is a net contributor to the economy through taxes (the revenue earned from tax and levies imposed on Tobacco far exceeds the net healthcare and other costs).

Here’s an article that makes an interesting read: http://bit.ly/2etLD5B

The paradox here is that the ‘health killer’ is almost a ‘bread winner’ (revenues from taxes exceeds costs to healthcare), To kill tobacco would be to”kill the goose that lays the golden egg”.

Despite Cannabis being a commodity, the economic characteristics could bear similar resemblance to that of the Tobacco industry. The Cannabis industry could consolidate and profitability concentrated in the hands of few heavyweights.

LikeLike

Good thoughts Don. I agree on lots of consolidation being one of the more likely outcomes for this industry.

LikeLike

THC can be consumed by smoking, drinking, eating

smoking was a result of prohibition and has a absorbtion time of 5-10min

drinking is the most socially acceptable method and has 30-45 min absorbtion

eating has limited social use, absorbtion 1.5hrs

look at TNY Tinley, this will be the end result of the commodity

THC infused Gin, Canadian Whiskey, Jamacian Rum, Amaretto

same board member as EAT

which has board connections with ACB, of which Chuck Rificci is on the board

LikeLike