A quick housekeeping note first. I recently moved from Cincinnati to Austin, TX which explains my blackout period of blogging. I was busy moving and getting settled in, but I’m finally back to a normal life. Blog posts will be more frequent now. If you happen to live in Austin, shoot me an email! Would love to meet some local investors.

Onto more important stuff. Fogo de Chao (FOGO, $10.52) is a Brazilian steakhouse with 31 locations in the US and 10 in Brazil (plus 1 junior venture in Mexico). I bet some of you are already turned off just because Fogo is a restaurant. I was too. Restaurant concepts come and go and they’re dependent on consumer tastes which can quickly change. Lots of good restaurants open, have a few years of success, and then slowly die as the initial luster wears off and people move on to the hot new concept down the street. I don’t think I’ve ever invested in a public restaurant group before, so hopefully the fact that I like Fogo so much says something (probably that I’m about to learn why restaurants are best avoided).

Fogo has a unique combination of national brand awareness while being under penetrated in their potential markets. This stems from them having locations all around the US dating back to 1997. Thus, most people have heard of Fogo even if locations are currently only in major metropolitan areas. A long runway for growth is the first thing that attracted me to Fogo. The second is their service style that gives them industry best operating margins. Finally, they have near industry best average unit volumes ($8+ million) and very positive Yelp reviews across their entire store base. All this means Fogo must be killing it right?

Wrong. FOGO has been a falling knife since May. There are several headwinds facing Fogo (and the restaurant industry in general) over the near term, but looking out 3, 5, or 10 years down the line, it’s hard to justify today’s stock price. I’ll get into all that stuff soon.

Business overview

Brazilian steakhouses are unique because the gauchos function as both cook and server. Each gaucho is in charge of cooking a different meat. When a skewer of that meat is finished cooking, the gaucho walks around the restaurant presenting it to diners and cutting off a piece if they wish. In addition, the soup, salads, and appetizers are all self-serve (basically a buffet). This results in operating margins from 13-17% the past couple years vs most full service restaurants in the 7-8% range (RUTH reached 12% in 2015). Another benefit of this concept is the flexibility in their meat offerings. Meat makes up over 50% of their food and beverage costs and protein pricing is largely a commodity that is out of their control. Luckily, they sell around 15 cuts of meat so they can adjust their offerings in line with what protein is facing more or less inflation. This has resulted in impressive food costs decreases in the face of protein inflation the past few years.

One risk of growing restaurant chains is proving success in different markets. There are many concepts that only seem to work in one city or region and then fail when expanding elsewhere. Thankfully, the 31 Fogo locations are spread all over the US in every major region. They have a national presence in big cities and are now filling in the gaps. Their future locations will be smaller footprints to account for smaller metropolitan areas. Whether Fogo thrives in smaller cities is one of the risks, but a couple factors give me optimism. First, Ruth’s Chris (RUTH) has 128 locations in the US and they are still expanding. Their average check of $79—compared to Fogo’s at $59—gives me confidence that Fogo’s lower priced offering has a long runway for growth. Second, Fogo’s only direct national competitor, Texas de Brazil, has a few locations in smaller metropolitan areas that have been open for years. However, Texas de Brazil is a private company so it’s hard to know how successful those units are.

At a store level, Fogo has implemented several new things to push revenue. This includes a focus on large group and event sales (great for getting a big group to try Fogo, higher average check as well), pushing alcohol more (their alcohol mix is 46% below peers), opening for lunch every day (lower average check, but hopefully increases guest count), and offering seafood for an upcharge. I don’t expect any of these things to make a huge difference in the long run—more of just the constant changes restaurants have to implement to keep comp sales growing.

Competition

Fogo is the only Brazilian steakhouse in town at six of their locations. There are very few cities where they compete with more than two brands (and I mean directly compete, obviously they compete with traditional steakhouses and all restaurants to a certain extent). In the 11 cities they have one direct competitor, Fogo has a higher Yelp rating in seven of those cities. In the 14 cities with two or more Brazilian steakhouses, Fogo has the highest rating in six of those cities and the lowest rating in one (they’re in the middle of the pack for the other seven).

The only other national Brazilian steakhouse is Texas de Brazil. Fogo and Texas de Brazil overlap in nine cities, all nine of which Fogo has higher ratings in (by a good margin). Over Fogo’s 31 US stores, they have an average 2016 YTD Yelp rating of 4.2 with only three locations under 4.0. In addition, their Yelp scores have remained pretty consistent since 2012 which is a good sign (2012 is as far back as Yelp shows).

Management/ownership

Larry Johnson has been CEO since 2007 after serving as Fogo’s lead counsel at Bakers & McKenzie (one of the largest law firms in the world) for many years. His base salary is $700k plus bonus, which is based on EBITDA, revenue, operational excellence, and employee retention. He currently owns 79k shares worth over $900k, plus he has beneficial ownership of another 323k shares (through options) that could be worth another $3.7 million. I wish Johnson’s ownership was higher, but I feel better that the private equity firm Thomas H Lee (THL) Partners owns 80% of Fogo.

In the majority of cases, I avoid any public company that has a majority owner. It’s too easy for them to take advantage of small shareholders for their own benefit. An individual or a founding family that owns over 50% can overpay themselves and not care about share price. On the other hand, a PE firm as the majority owner is better because they’re focused on getting a return on their investment just like I am. The two THL representatives on the board earn $0 for serving. THL will also need to get out of their investment at some point so a sale of the company in a few years wouldn’t surprise me.

Bear case

While there are quite a few headwinds and macro headlines negatively affecting Fogo, I have yet to hear a bear case for why this won’t remain a good company in five or ten years. If Fogo keeps selling food and can replicate their success in more cities, the stock is going to be a fine investment. If anyone is short FOGO or has seen a legitimate bear case, I’d love to see it. Right now I feel like I’m missing something which scares me. Below, I’m going to go through all the negative headlines against FOGO that I’ve heard and give my thoughts on each.

Audit revealed “material weaknesses in internal control over financial reporting.” No one wants to see that in the 10-K of one of their investments. In Fogo’s case I’m not too concerned. They had incorrectly put some expenses in operating cash flow that were supposed to go into investing cash flow instead. In my opinion, the wrong way they were accounting for those expenses was actually more conservative than the GAAP method, which makes me think it wasn’t anything nefarious. Hopefully it was just an example of going public and adjusting to being held to a higher accounting standard.

Fogo is a gimmick and old locations will do worse as the uniqueness wears off. It’s hard to disprove this, but older locations are some of the best reviewed on Yelp, including their first US location in Addison, TX that did $10 million in sales in 2011 (14 years after opening). Also, 62% of their clients visit more than once a year.

Millennials don’t like chain restaurants. All things being equal, I definitely prefer independents over large chains, but last week my girlfriend and I ate at Fogo and we were very impressed with the food. Going in, I expected my impression to be “It was good, but I’d rather spend $60 on one perfectly cooked steak as opposed to ten that aren’t as good.” Boy was I wrong. We only had one cut of meat that wasn’t great (the seasoning was off or something), but everything else was delicious. I liked it more than I thought I would. Also, it’s an expensive restaurant so it’s always going to trend towards an older crowd anyway as they generally have more discretionary funds.

Minimum wage increases. This sucks in the short-term, but it affects all their competitors and the cost eventually gets passed through to the consumer.

Brazil is in the shitter. Brazil is going through a horrible recession that seems to have maybe hit a bottom earlier this year as some signs are pointing to a recovery. This directly affects Fogo through their ten Brazil restaurants (16% of 2015 revenue), but also through currency exchange which has hurt them the past three years. The forex aspect has finally stabilized the past couple months. The effect of these Brazilian locations will slowly decline over time as management plans to open five US stores per year for the foreseeable future and only one in Brazil every 1-2 years.

Zika. Zika certainly isn’t helping the Brazilian economy and it’s starting to affect the Gulf Coast states as well. Fewer people are traveling to Florida (and Brazil for that matter) as Zika is spreading up the state. Fogo has two Florida locations which have been hurt by the decreased tourism. As much as Zika sucks for pregnant (or trying to be pregnant) women, I don’t see it having a long-term negative effect on tourism or people willing to go out and socialize. For the vast majority of people that contract Zika they maybe get sick for a few days, are completely fine two weeks later, never realize they even had it, and are now immune to it. As more of the Brazilian population becomes immune, it will become less of a problem. Stateside, the CDC seems to be doing a much better job controlling the virus in Florida than what happened in Brazil.

Texas locations are hurting from the oil collapse. Fogo has five locations in Texas that are starting to see varying effects from the oil collapse. The longer oil prices stay low, the more those local economies that depend on it will be affected. If “lower for longer” oil prices remain, this could be the new normal in Texas.

Consumer spending has recently pulled back in the US. This may be a sign of a coming recession or just normal variance, I don’t know. I guess we’re coming due for a recession after a long recovery, but nothing makes me think it’ll be anything like 2008-2009. A recession would probably hurt Fogo worse than most full-service restaurants though, thanks to their price point. The more expensive the restaurant, the more discretionary it is. Ruth’s Chris operating margins in 2008 and 2009 were less than half of what they were in 2014 and 2015. In addition, their comp sales were down double digits in both 2008 and 2009. Fogo management has said their comp sales were down single digits during the collapse. Worst case scenario is probably Brazil’s recovery taking a long time while the US enters into a recession of their own.

Valuation

I want to start with a kind of back-of-envelope valuation. Let’s assume at yearend 2014 that Fogo decided to stop opening restaurants. In 2015, all pre-opening costs and growth-related capex never happened. Next, let’s normalize the one-time (mostly IPO-related) expenses and their occasional restaurant refreshes to get new, steady-state results for 2015 (numbers below in millions).

Now, D&A is a little high in that example and 2015 was an above average year for the restaurant industry, so we can be conservative and take that $1.24 down to $1.00 and call that normalized, no growth earnings. That means FOGO is currently selling for just over 10x a steady-state level. To me, this seems cheap for a restaurant that’s been around for 37 years (19 in the US), has never closed a store, has industry-best margins, and is still getting very good reviews across their entire store base. If it’s fairly valued (or cheap in my opinion) on a steady-state basis, the next question becomes: what about the new units?

We’re not in some fantasy no growth land—quite the opposite actually, management’s goal is to open five new US stores per year. If steady-state is fairly valued and new stores are value accretive, then FOGO must be undervalued. And if you think 10x on no growth earnings is already cheap AND future stores are value accretive, then FOGO is very undervalued.

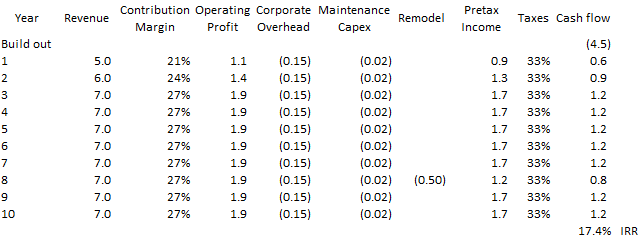

Management’s goals for the new, smaller units are $7 million in sales when fully ramped up (vs $8 million at current stores), a 27% contribution margin (vs 31% at current stores), and a $4.5 million build out cost. Using these numbers, and assuming new units shut down after ten years, results in a 17.4% IRR (as shown below).

But, as we all know, CEOs are optimists. I think toning down their estimates is prudent. In the below table, I use $6.5 million for fully ramped sales, 25% peak contribution margins, and a $5 million build out cost. As you can see below, these numbers result in a 10.6% IRR for new units, thus still creating value. And if these stores are cash flowing $1 million per year, they won’t be shut down after ten years so these IRR estimates are still too low.

While that back-of-envelope method shows the stock is cheap, a more involved DCF can get a ball park of just how cheap. Going through my entire DCF is not possible in a blog post, but here are my high level assumptions:

- -6% comp sales the next two years while operating margins compress by 40%.

- After this two year economic slump, comp sales go to 4% for two years and then 2% thereafter. These assumptions lead to average unit volumes at the current established store base not returning to 2015 levels until 2021.

- Operating margins rebound in step, but never return to 2013-15 levels.

- They open five US stores per year and one Brazil store every other year through 2020. No stores open after 2020.

- New stores never reach management’s expectations, only achieving the results in the second example above.

- Zero value given to junior ventures (one of which is already up and running, another is soon to be). I didn’t even discuss these, but suffice to say they cost Fogo zero dollars and could add substantial value years down the line. All JVs are international.

- All outstanding options vest and share count increases 2% per year.

- 11% discount rate.

- 12.5x terminal value on 2021 cash flow.

Those assumptions result in a per share value a little under $20. With that being said, I can put anything in a DCF to get any result I want. But if I can use numbers worse than they’ve accomplished in years past, assume future stores do worse than management expects, and the value it spits out is still far above today’s price, that gives me some confidence. Though I still prefer the valuation of “stock is cheap on a steady-state basis + new units add value = stock is really cheap.”

There are perhaps more Fogo competitors in Houston than you are aware of, but that’s not necessarily a negative as much as the power of the concept. I would be more concerned that its an expensive dinner meal. My guess is that the vast majority of customers are on an expense account, so business would be quite dependent on the business cycle.

LikeLike

In the biggest cities (Houston, Chicago) I only looked at competitors that were reasonably close to Fogo. For example, I don’t think their location in The Woodlands is competing with a Brazilian steakhouse on the south side of Houston. Alas, it’s still possible I missed a few places on Yelp.

LikeLike

Great write-up. I’m bullish on FOGO as well but I do have a few concerns which I don’t think you touched on here.

1) Forced seller in TH Lee. They own 80% of the float out of a 2007 vintage fund. They will have to liquidate in the next 2 years. Some have speculated that it may be a takeover target, but I don’t see it. When THL decides to get out it’s going to put serious pressure on this price. This is transitory and irrelevant to the strength of the business, but a concern nonetheless.

2) YTD results in 2016 are puzzling. They’ve opened 6 stores in the U.S. since Feb 2014, and projecting almost no pickup in 4-wall profit in the U.S. For a business which such a sound unit expansion model, something is not adding up here. It’s hard to tell how much of the flatness is driven by declining SSS or weakness in new units, but when I see the unit base rise by that much with almost no additional profitability to show for it (indeed, a decline in EPS), I get worried.

3) The debt. Not a problem at all if earnings hold up as the business should generate $15-$20MM of cash flow p.a. The concern here is if there is a protracted recession (which I would bet on) that knocks down SSS by double digits, Fogo’s credit position will deteriorate significantly. I believe they have a seven year facility (may be wrong on this, but I know its somewhere between 5-7). If they are in the midst of a slowdown when the principal comes due, they are going to have to refi on poor terms.

Did you give any attention to the above three points?

LikeLike

Good questions Jerrod:

1. Curious why you say FOGO wouldn’t be a takeover target? I think some of the big restaurant groups could be interested for many of the reasons stated in my blog post. With that being said, I’d be surprised if THL tried to liquidate 80% of a public company on the market. They know that’d crush the price. One option could be selling chunks in private deals. Either way, an 80% forced seller would no doubt hurt short-term results, but I’d gladly be increasing my position on the way down. I’ll admit I’m not very knowledgeable on how PE funds operate in these scenarios.

2. Tony (the CFO) told me the 2015 stores are annualizing around $5M in revenue per store right now, which makes them cash flow positive. US top line is up high single digits this year, but comp sales and Brazil (and forex) are hurting them.

3. Their comp sales in the financial collapse never went negative double digits so that gives me some comfort. If a bad recession happens and their results retract similar to how RUTH’s did during 08/09, then yes they could have a problem. I view that as a very unlikely event given RUTH’s higher check, FOGO’s comp sales during the last collapse, and FOGO being a more unique concept than RUTH. In my DCF example in my valuation section above (-6% comp sales, 40% operating margin compression) they still easily cover interest expenses.

LikeLike

Thanks for the reply, Travis. Just a couple brief points of follow-up:

1) Let me qualify my skepticism on the takeover: I don’t see financial sponsor taking this thing private after what some may call a ‘failed IPO’ by THL. I don’t disagree that it’s a solid business, but I am not aware of very small cap high end restaurant chains getting bought by strategics. That said, I don’t know the restaurant industry well, so I may be way off. Any companies like FOGO get acquired recently?

2) That is good to know and allays my concerns on the newer units. Those units must be barely breaking even because 4-wall profit in the U.S. is dead flat YoY for H1. That said, my model shows about $50k of contribution on $5MM of revenue, so it more or less checks out.

3) Definitely not concerned about interest coverage here. I’m more concerned about having to refinance under onerous terms if earnings take a hit.

I, like you, am a buyer and am willing to live with these risks as I think there is limited downside here.

Thanks for the thoughtful replies.

LikeLike

You’re welcome. I am not aware of any similar sized restaurant acquisitions recently. Though if I thought there were any public restaurants like FOGO I probably wouldn’t like them as much 🙂

With respect to the financing risk, I think it’s a low risk but as with any company that has debt it’s something to keep an eye on. Debt matures in 2020, a lot can happen in that time frame.

LikeLike