My original write-up on Consolidated-Tomoka (CTO) was titled “No Downside, Unknown Upside.” The situation has improved dramatically since then, we have a better sense of what NAV may be (that unknown upside is becoming more known), and yet the stock is only up 5.3% since my first post (now trading at $56.08). I have been adding to my position as of late. If you’re not familiar with the CTO story, I recommend reading my initial write-up prior to the below update.

Recent announcements

On November 7th, Albright (CEO) announced their intent to sell their subsurface mineral rights (490,000 surface acres of land located throughout Florida). I previously valued the mineral rights at $0 so anything they get is gravy in my eyes. In the linked article, Albright commented that “We might be able to raise enough to invest in two or three more income-producing properties.” 2-3 income-producing properties could be a wide range of value, but $10-20 million seems like a conservative guess. I use $10 million in my valuation below.

On November 12th the Tanger Outlet deal closed for $249,000 per acre. This was better than expected yet the market had zero reaction. A couple other smaller deals have been completed and there should be 1-2 more in the coming weeks, but they’re not terribly important to this update.

The biggest news of the past four months came on November 20th when David Winters (of Wintergreen Advisers, owner of 26% of shares) issued a proxy for the 2016 shareholder meeting for management to sell or liquidate the company. This is a total guess, but I suspect this proxy is mostly fueled by pent-up frustration on Winters’ end. CTO has been one of his fund’s largest holdings for almost ten years and it’s up a total of 12.6% based on his average reported price on Dataroma. I don’t blame him. He also knows that, even if unsuccessful, issuing this proxy will bring attention to CTO’s undervaluation. Either way, as the title of this post suggests, I think this has created a unique win-win scenario for investors. If Winters convinces another 25% of shares to vote alongside his 26%, the company will be put up for sale and a transaction could occur in the next 12 months. Based on my updated NAV calculation below, I think a sell price should be over $90 (60%+ premium over today’s price). If Winters is unsuccessful in his proxy, Albright will continue growing the company as he’s done since coming onboard in 2011. A few more years of performing and a $120+ share price is not unrealistic.

On December 11th they listed 14 of their income-producing properties on LoopNet at a cap rate of 4%. In my previous valuation I was overly conservative with a cap rate of 7%. Even if we assume 4% is a lowball listing and their entire income-producing portfolio is worth a 6% cap rate, just this increases the NAV of the company by over $30 million.

Shareholder frustration

Many shareholders (led by Winters) are very frustrated by CTO’s stock performance and are blaming Albright and management for not putting more effort into communicating how undervalued their stock is. If I owned this stock since 2006 I’m sure I’d be more frustrated, but I just don’t see this as a major issue. In my eyes it’s pretty obvious Mr. Market is way wrong on this one, but he’ll get it right eventually. Quite frankly, I prefer management that focuses on running the company and not stock promotion. With that being said, I was as shocked as any other investor by the lack of market reaction to the Tanger announcement, but the silver lining is I’ve been able to add more shares in recent weeks around the same price. The most efficient way to signal to the market of their undervaluation is probably a large stock buyback. At these prices, buybacks will be accretive to shareholder value and will most likely get a lot more investors looking at the company.

Updated NAV

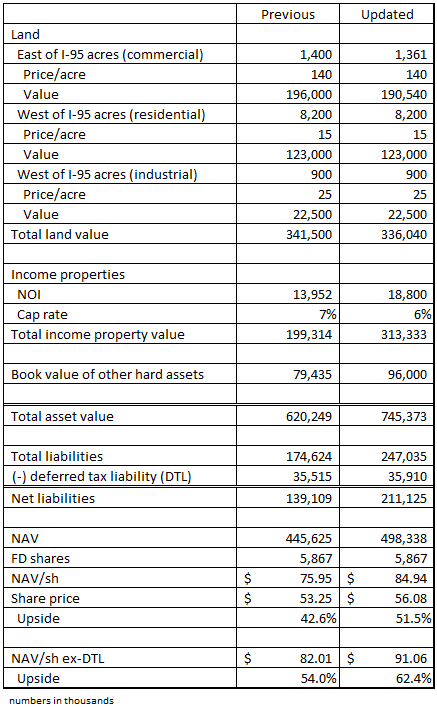

With several deals announced since the latest 10-Q (dated 9/30/15), I have to make some estimates in calculating NAV. I’ve basically assumed that sales were additive to cash and purchases were additive to debt. In the latest investor presentation (dated 11/23/15) management stated pro forma net operating income (NOI) is $18.8 million. For the sake of comparison, the left column is my unchanged NAV estimate from my original write-up (dated 8/31/15) vs the right column which is updated as of today.

Nice write-ups on CTO Travis. I’ve been following this company since I heard you on some podcast. Curious how you’re taking into account the off-balance sheet liability that is the G&A expense. I get a NAV of between $70 and $85/share without taking into account annual management and corporate expenses, but if I capitalize the G&A expense my value drops by $10-$15/share.

Are you betting on a liquidation? Or is the $6-$8 million in annual costs being deducted from something i’m missing in your write-up.

LikeLike

tj,

Thanks for the comment. I’m not betting on a liquidation (surprised Winters even suggested it actually). If someone like St. Joe (JOE) or a REIT acquired CTO, I think much of that G&A expense would be redundant and thus eliminated. Triple net leases and raw land aren’t hard to fold into another operation. Even if you want to include some capitalized expenses here, enough to equal a $10-$15/share decrease in NAV seems like overkill to me.

LikeLike

Any idea about the drop today? I don’t see any material filings.

LikeLike

David Winters filed another 13D, you can read the full letter here: http://www.sec.gov/Archives/edgar/data/23795/000091957415008720/d6673322a_13d-a.htm

He’s basically making two allegations against management: lack of disclosure on their securities portfolio and increasing debt. Suffice to say, I don’t think either claim has much merit. Winters clearly wants the company sold and he needs investors to vote alongside him for that to happen. Their securities portfolio is meaninglessly small and the debt increase is directly related to income-producing properties which has been the business plan all along.

I have a lot more thoughts on the letter, but this comment would be longer than the actual blog post. I will probably write another blog post soon detailing my thoughts. Feel free to email me until then.

LikeLike

Thanks for your reply. Winters has been issuing threats since last month so it was nothing new with this latest 13 D. I think it might be impacted by the new restrictions on REIT spinoffs in the recent house budget bill. That was one of the catalyst ( although CTO doesn’t need one IMHO) .I might have to go through that bill and see what the impact is but your feedback will be highly appreciated. Here is the link.

Click to access 121515.250_xml.pdf

LikeLike

Val,

Thanks for posting, I wasn’t aware of the new bill but I did some cursory reading on it. As you stated, the main purpose appears to be patching up tax loopholes with current REIT spin-offs. There are quite a few other things that affect REITs as well, but nothing pops out to me that would influence CTO now or in a REIT conversion down the road. These new laws may restrict potential acquirers of CTO (assuming they’re REITs), but again, I don’t see anything major. Was there something specific in there you were concerned with that’s going to affect CTO? Below are two sources I read through analyzing the new bill. Subtitle B is the section relevant to REITs.

Click to access 114-SAHR2029Ex-SxS.pdf

https://tax.thomsonreuters.com/media-resources/news-media-resources/checkpoint-news/daily-newsstand/checkpoint-special-study-reit-reforms-in-the-protecting-americans-from-tax-hikes-act/

LikeLike

I am going to check weather they can still offset the deferred tax liability on the gains of sales by doing a 1031 exchange to REIT and paying distribution. That alone would have saved them $7/ share according to their CFO. From a cursory glance, nothing seems concerning.

I was surprised by 7% drawdown on Winters’s 13 D but looks like the stock came back. This stock is so misunderstood that nothing should surprise me any more.

LikeLike

Btw here is the link about that $7 savings

LikeLike